28+ Home loan payment calculator

If you have a car or home loan. You can potentially get a conforming mortgage with a down payment as low as 3.

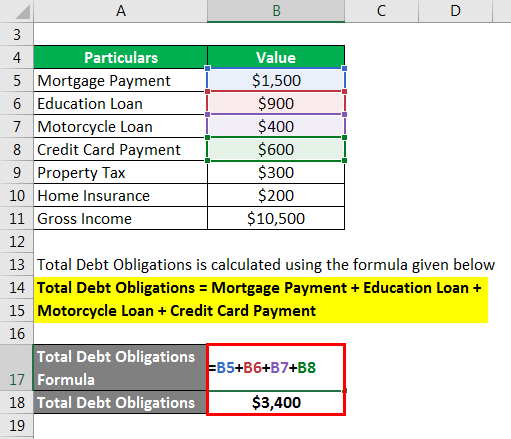

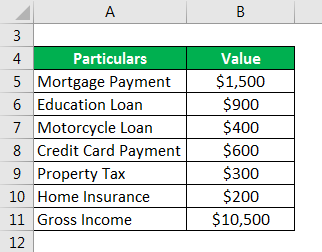

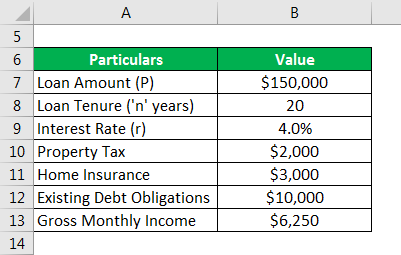

Total Debt Service Ratio Explanation And Examples With Excel Template

However this loan typically requires private mortgage insurance PMI which should be added into your monthly expenditures.

. Student loan calculator. You can obtain 15-year fixed home loans from the following types of conventional loans and federally-backed housing loans. If you do not meet the repayments on your loan your account will go into arrears.

One can enter an extra payment and a rate of depreciation as well to see how an ATVs value may decrease. Your age is one of the main factors determining your home loan eligibility and it may affect your monthly payment and interest rate for the given loan amount. Borrowers have a variety of options for paying off home loans prior to the maturity date.

Get home equity loan payment estimates with US. Leverage Your Home Equity Today. Home Loans Amortization Tables.

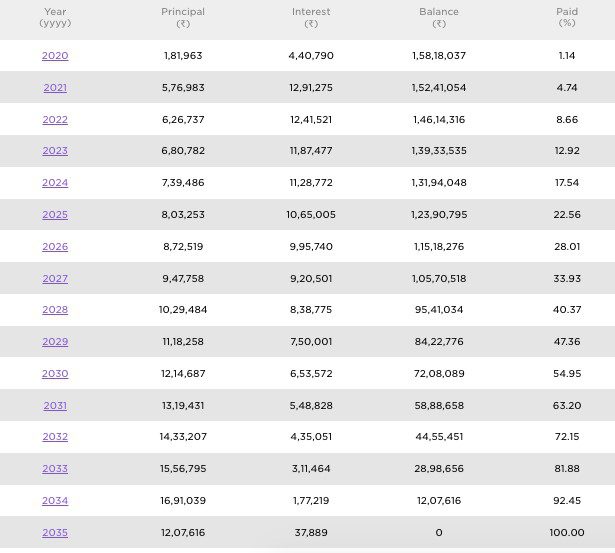

They are long term loans which can be repaid up to a maximum of 30 years. The size of homes also increased significantly. Interest burden is maximum in initial months.

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a. Buy Calculator considers one-time costs closing costs and the down payment and ongoing expenses like property taxes an HOA fee home insurance and private. Then once you have computed the payment click on the Create Amortization Schedule button to create a chart you can print.

You get the pie-chart representation for the monthly payment EMI the total interest payable and the total payment interestprincipal. Hence loan prepayments made in initial months saves the most amount of money. Mortgage loan basics Basic concepts and legal regulation.

This method gives the property owner a home free and clear of debt. Suppose you want to buy a house priced at 300000. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

Another low-down-payment mortgage option is the FHA home loan for which 35 down is acceptable. On a 400000 home a 20 down payment would mean you need 80000 up front. Use LIC home loan EMI calculator Sep 2022 to know your home loan EMIs instantly for free with quick online approval at Wishfin.

If you are young you may opt for a long loan tenure and get a loan with a lower EMI and low home loan interest rate. Your monthly income will influence. You may have to pay charges if you pay off a fixed-rate loan early.

The earlier we start home-loan-prepayment the better. Purpose of home loan prepayment is to save the interest component. Factors that affect your home loan eligibility Your age.

2891036 2000000. See the results below. Interest then gradually falls in later months.

From 1963 to 2019 the median home price in the United States rose from 18000 to 321500 compounding at 528 annually. How to Calculate a Down Payment Amount. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

Follow the tried-and-true 2836 percent rule. Annual real estate taxes. To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts.

This calculator will compute a loans payment amount at various payment intervals -- based on the principal amount borrowed the length of the loan and the annual interest rate. Marcus by Goldman Sachs currently has highly-competitive interest rates at 599 APR to 2899 APR for non-New York residents. Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options.

The USDA home loan also requires zero down payment and offers similar rates to VA loans. A home down payment is the part of a homes purchase price that you pay upfront and does not come from a mortgage lender via a loan. Apart from being a loan purchase tool a 15-year fixed rate loan is used as a refinancing tool by homebuyers who want to shorten their loan term and change to lower rates.

This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment. Check terms and rates for a home equity line of credit today. It allows home owners to borrow against.

A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. 15 Year vs 30 Year Loans. Over the same time period the average US home price increased from 19300 to 383900 for a 548 compounded annual rate of return.

10 25012 1001390 30. Banks home equity loan calculator. Note that this calculation may be different.

Loan Payment Calculator. The cost of your monthly repayments may increase. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

PMI is usually 05-1 of the cost of the home loan but may vary depending on credit score. Home loans are sanctioned on the basis of the property cost and the borrowers repayment capacity. You can also use the calculator on top to estimate extra payments you make once a year.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Interest load is maximum in initial months. Different Housing Loans with 15-Year Fixed Terms.

30-Year Fixed Mortgage Principal Loan Amount. If you do not keep up your repayments you may lose your home. Simply enter the amount you wish to borrow the length of your intended loan vehicle.

Many financial advisors believe that you should not spend more than 28 percent of your gross. As of July 28 2022. For home buying the Rent vs.

Index plus a margin. An ATV loan calculator that allows one to enter data for a new or existing ATV loan to determine ones payment. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

Paisabazaars Home loan EMI calculator has been designed to be user-friendly and it helps individuals calculate their home loan EMIs instantly. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

Or even a credit card for that matter the amount you pay back each month reflects principal and interest payments applied toward the cost of purchases.

Tables To Calculate Loan Amortization Schedule Free Business Templates

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

3

1

Coding For Kids Coding Preschool Lessons

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Sbi Home Loan Interest Calculator Discount Save 40 Civilsamhallespodden Se

3

1

Pin On T I P S I D E A S

Run Chart Templates 7 Free Printable Docs Xlsx Docs Pdf Run Chart Templates Excel Templates

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Words

Tables To Calculate Loan Amortization Schedule Free Business Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template